In almost all reporting in Dentrix (with exceptions discussed below in this article), the following rules apply:

- Any transaction that reduces a patient balance, which in turn decreases the Account Receivables (A/R), counts as a Credit or Collection.

- Any transaction that increases a patient balance, or increases the A/R, is a Debit or Production.

Sometimes, this very black-and-white way of viewing the numbers is not desirable. The problem is demonstrated in the following examples:

Situation 1: Discount or In-Office Write-Off

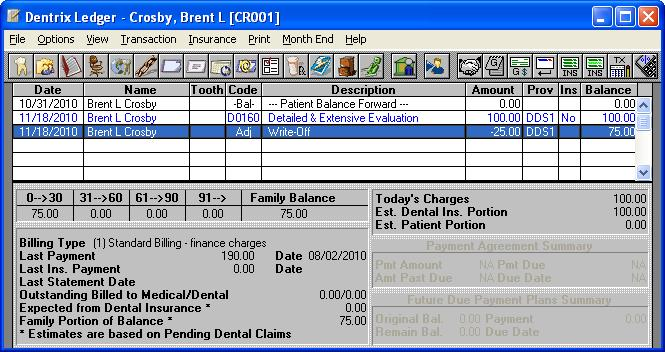

The office posts a procedure(s) that charges the patient. (example, $100)

The office posts write-off adjustment in order to not charge the patient full price. (example, $25)

Strictly by the mathematical rules, that write-off adjustment may look like $25 collection received.

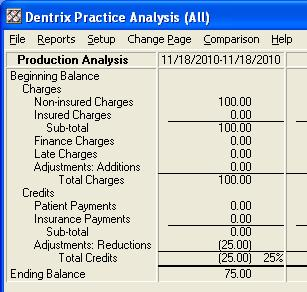

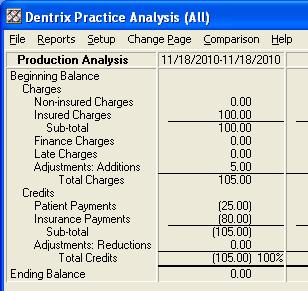

This detail shot of the Practice Analysis shows how these transaction look (assuming that these were the only transactions performed for any patient that day)

Since $25 was never really brought in, this makes the total credits look odd.

The more logical, preferred way of viewing the information would be to consider that write-off adjustment as $25 of money as never charged (in other words, the production should reflect $75 rather than $100). This would be known in accounting terminology as the 'Adjusted Production'.

Situation 2: Insurance Overpayment Refund Adjustment

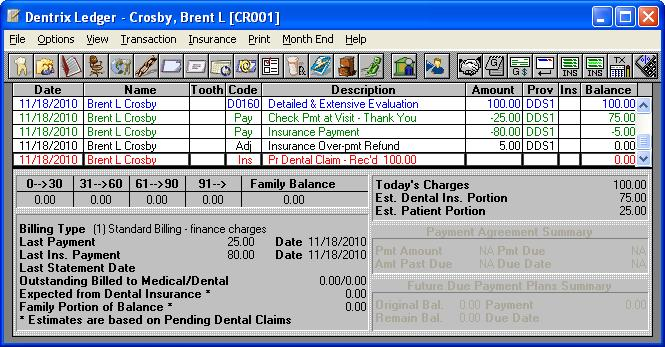

- The office posts a procedure(s) that charge the patient $100

- Pretend that the coverage tables, deductible, etc. work out that the insurance estimate is $75, with the patient owing $25

- Pretend that the office charges the patient $25 and bills the insurance.

- Later, the office receives a payment from the Insurance carrier that was higher than expected, for $80 (instead of $75)

- Entering that payment causes the patient balance to be - $5 (or a credit of $5)

- The office issues a Refund Adjustment, which adds $5 to the patient balance, bringing their balance up to $0.00.

Mathematically, that refund adjustment added to the patient balance and so, by strict definition, increased the balance and the AR, and counted as a production on some reports.

This detail shot of the Practice Analysis shows how these transaction look (assuming that these were the only transactions performed for any patient that day)

However, using a logical way of thinking, the office did not produce the refunded $5. Rather, they lost that $5 out of their real money collected.

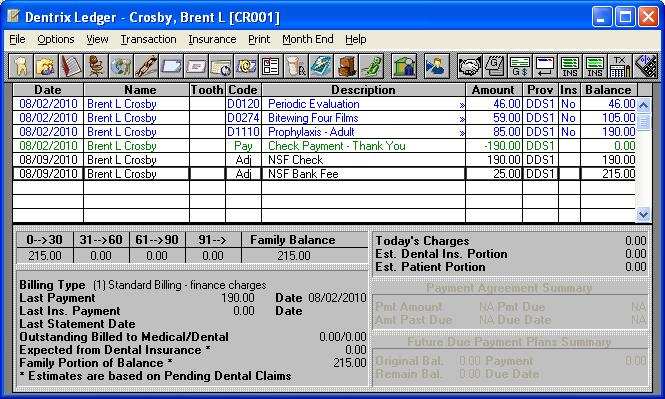

Situation 3: Insufficient Funds / Returned Check

A patient had dental work performed totaling $190, and paid by check. Later, the check was returned with insufficient funds. Using an adjustment, the office charged / debited the $190 back to the account, as well as an additional Returned Check fee of $25.

Strictly mathematically, the NSF adjustments added to the patient balance and so, in the strict definition, increased the balance and the AR, and counted as a production on some reports.

Meanwhile, using a logical way of thinking, the office did not produce the $190 a second time. Rather, they lost that $190 out of their real collections.

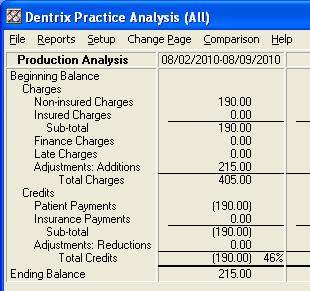

This detail shot of the Practice Analysis shows how these transaction look (assuming that these were the only transactions performed for any patient in that time period).

The logical thinking expressed in the above situations is called “Adjusted Production” or “Adjusted Collection”

The Exceptions:

Three areas of the program can accommodate the idea of Adjusted Production or Adjusted Collection.

Provider A/R Totals

Practice Advisor Report

DXPort

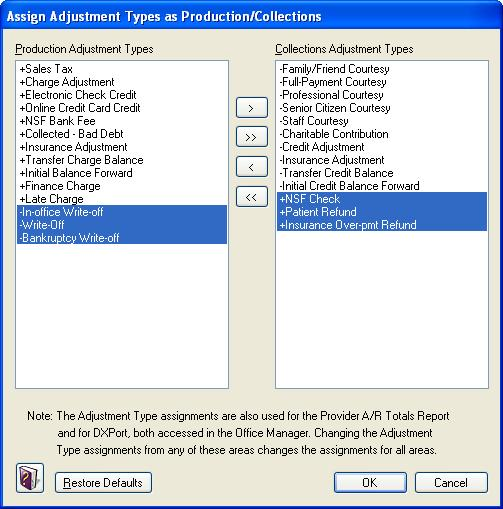

In these reports, it is possible to reclassify an adjustment type from the collection side over to the production side. Adjustments such as write-offs, NSF Checks, and refunds can be moved from the default assigned category to the desired category, so that they will reflect on the Provider A/R Totals, Practice Advisor Report, and DXPort totals in a logical, adjusted way.

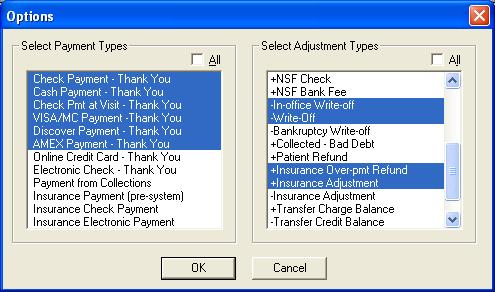

Screen shot screenshot is from the Practice Advisor Report setup options. A similar screen is available in the Provider A/R Totals report options.

This has been a frustration especially for offices printing Day Sheet Reports. The Receipts Only Day Sheet and the Deposit Slip can only show actual money received (collection), but do not show adjustments. The Adjustment Only Day Sheet can show adjustments, but not money collected. Offices have logically desired a report accommodate accomodate refund adjustments as counting against the money collection.

The Daily Collection Report was created to handle this request. Using the Options button, offices may choose to show all or selected types of money collected, and also show certain types of adjustments that they consider “adjusted collection” (or in their logical accounting methods, adjustments that count against the collection). They should carefully consider, in their accounting circumstances, which collections and adjustments should be displayed on this report, and select those accordingly. This report will then allow you to consider adjustment adjustement alongside your actual money collected, and to make better decisions on your internal accounting of the funds.